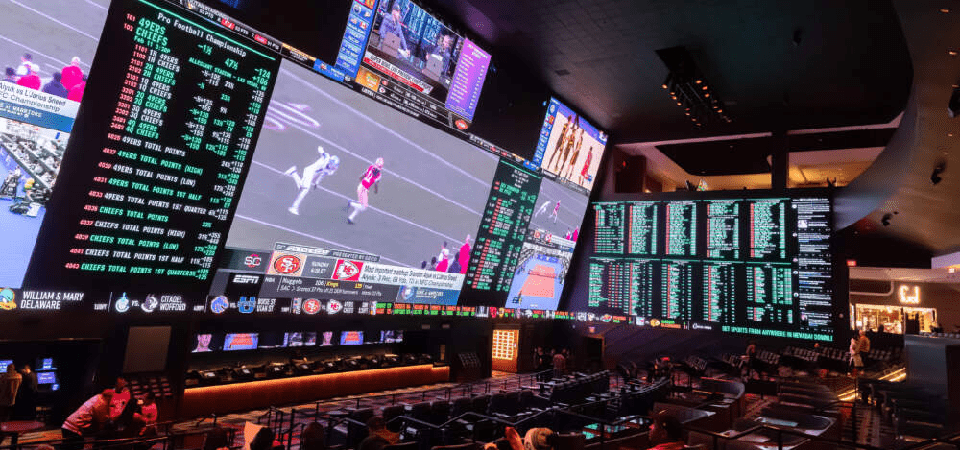

Some Sports Bettors Skip Bills, Including Rent, to Fund Wagers

There are financial drawbacks to the growing availability of regulated online sports betting in the US, and a recent survey reveals the harsh realities some bettors face.

A recent survey by U.S. News & World Report found that one-fourth of gamblers reported missing a payment due to insufficient funds from gambling losses, with some even claiming that they have neglected to pay their rent. They’re additionally jeopardizing their financial circumstances and credit ratings in other ways.

"Almost a third (30%) of sports bettors say they have debts they attribute to gambling. Of those with debts related to sports betting, more than half (51%) are facing debts of $500 or more,” according to the study, which was conducted earlier this month in conjunction with PureSpectrum.

A survey was conducted with twelve hundred sports bettors throughout the US. Everyone mentioned they made sports bets in the past six months.

Gamblers Compounding Difficult Circumstances

A small fraction of sports bettors achieve long-term success, indicating that the odds favor experienced players, especially if novices fail to use effective money management strategies. It seems that many are not engaging in that.

Even more troubling, some are intensifying situations that are already unfavorable. The U.S. News poll shows that 15% of surveyed sports bettors have acquired personal loans to support their betting behavior, while 12% have taken out payday loans, notorious for their high interest rates.

This aligns with research published last year by the University of California Los Angeles (UCLA) and the University of Southern California (USC), which observed that in states where online sports betting is permitted, consumer bankruptcy filings were increasing and credit scores were declining.

Other methods in which losing gamblers are deteriorating their financial situations include the buildup of credit card debt. Fifty-two percent informed U.S. News that they maintain monthly balances on their credit cards, a situation exacerbated by many likely being unaware that card issuers classify transactions with online sportsbooks as cash advances rather than regular purchases, resulting in higher interest rates on those transactions.

An additional 45% report that their gambling habits have hindered their capacity to save adequate emergency funds to cover three to six months of costs. This serves as another reminder that data shows some gamblers make poor choices, such as liquidating investments, to bankroll their activities.

Increased Shadows in Sports Gambling

Another downside that has come with the expansion of US sports betting is the increase in bettors verbally harassing athletes, whether at games or on social media, as a result of losing bets. Some have gone to the extent of targeting athletes' families or issuing death threats. Even more troubling, it's adults who are engaging in these offenses.

"21% of sports bettors say they’ve verbally abused an athlete, either in person or online, after losing money on a bet. More than a quarter of respondents between the ages of 35 and 44 say they’ve lashed out at an athlete over a wager, the highest rate of any age group in the survey,” according to U.S. News.

The research revealed that 25% of participants acknowledge their gambling behavior is unmanageable, and almost 10% have pursued help for their issue. Everything occurred due to fairly modest bet amounts. Approximately 75% of participants bet less than $500 each month.