Gabelli Says It’s Time to Bet on Caesars Stock

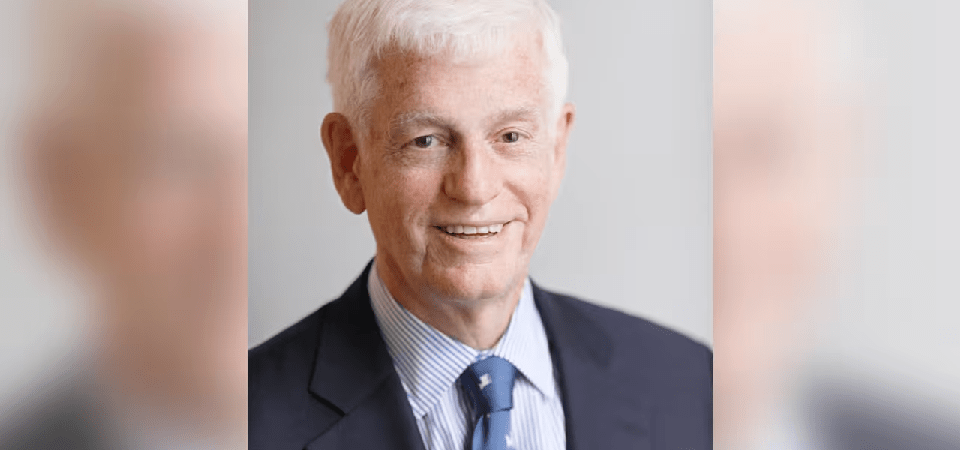

Mario Gabelli, the CEO and chairman of Gabelli Funds, has an extensive background in investing in gaming shares. Include Caesars Entertainment (NASDAQ: CZR) in that category.

In the most recent issue of Barron’s “Roundtable,” Gabelli identified Caesars as one of the 10 stocks he is currently most optimistic about. Among the 11 members of the financial journal’s stock-picking group, Gabelli was the sole individual to reference any gaming stocks. He mentions the possibility of a cash flow turning point as one reason it’s “time to place a wager” on the second-largest operator on the Las Vegas Strip.

"We see a significant turnaround in cash flow. Caesars is working down its debt, and repayments will accelerate,” Gabelli told Barron’s.

The gaming firm holds $11.5 billion in debt, and its strategies for reducing this liability have been thoroughly recorded. Those strategies might include selling assets, yet the Harrah’s operator hasn't divested any items this year, raising doubts that the present macroeconomic climate favors consolidation in the gaming sector.

This might stem from persistently high interest rates, which are significant to Caesars' investors for a different reason. Because of the company's significant debt load, some estimates suggest it could reduce its annual interest costs by up to $60 million for every 100 basis points the Federal Reserve decreases rates.

Gabelli Discusses Ichan's Role in Caesars Shares

Gabelli remarked that activist investor Carl Icahn possesses 5% of Caesars stock, although he didn't explicitly state that this was a reason to hold the shares.

Icahn’s re-engagement with the casino operator hasn’t boosted the shares. The stock would have to increase roughly 10% to reach its level in May 2024, when it was disclosed that the investor was involved with it again.

Nonetheless, Icahn’s engagement with Caesars might bolster Gabelli’s optimistic view. In March, the gaming firm appointed two directors connected to Icahn to its board. Although Icahn has stated he’s not advocating for activism, he’s in favor of Caesars separating its digital operations, which encompasses Caesars Sportsbook.

Boosting profitability in that division isn’t shown in the stock price, and through divestment, the company could generate shareholder value while obtaining capital for debt reduction or share repurchases—elements that could strengthen Gabelli’s optimistic perspective on the stock.

Gabelli Continues to Favor Golden Entertainment as Well

In the January issue of the Roundtable, Gabelli informed Barron’s that he favored Golden Entertainment (NASDAQ: GDEN), a perspective he maintained in the midyear update even though the stock had risen only 1.80% since the beginning of 2025.

“(Golden’s) underlying real estate is worth the intrinisic value of the company,” Gabelli told Barron’s.

The investor has a positive outlook on certain gaming-related companies as well. These consist of Fox Corp. (NASDAQ: FOX) and Sinclair Broadcasting (NASDAQ: SBGI). The former is entitled to obtain as much as 18.6% of FanDuel, while the latter holds warrants for the purchase of 11.5 million shares of the regional casino operator Bally's.